Beyond Speculation: The Utility of Prediction Markets

Nov 17, 2025

People argue that the word "markets" in prediction market is a hoax, that sites like Polymarket and Kalshi are pure gamblig dressed as finance. I would argue the opposite. Gambling was the trojan horse, the gateway to a new layer of financialization these platforms are quietly building.

Behind every bet is a market trying to price uncertainty. Underneath that gambling surface lies something more profound: a financial mechanism designed to extract truth.

Prediction markets are real financial markets.

And as you may know, markets can do two things better than any other system:

Transfer risk.

Aggregate information.

The information side is easy to see. Prices move because markets compress collective expectations into a single signal. What’s harder to notice is the second layer :risk. Prediction markets don’t just reveal what people believe; they let participants transfer the cost of being wrong.

That’s what turns speculation into a real market. In this article, we explore both sides of that mechanism: how prediction markets can hedge volatility in fast, but flawed digital economies, and how they can forecast delayed realities in slow-moving markets like real estate.

Counter Strike Skins

Counter-strike skins have an obvious liquidity problem. Not because there aren't enough trade counter parties, but because it was designed like this by its creators. Valve, the Counter Strike creators, impose a one week trade cooldown after each skin transfer.

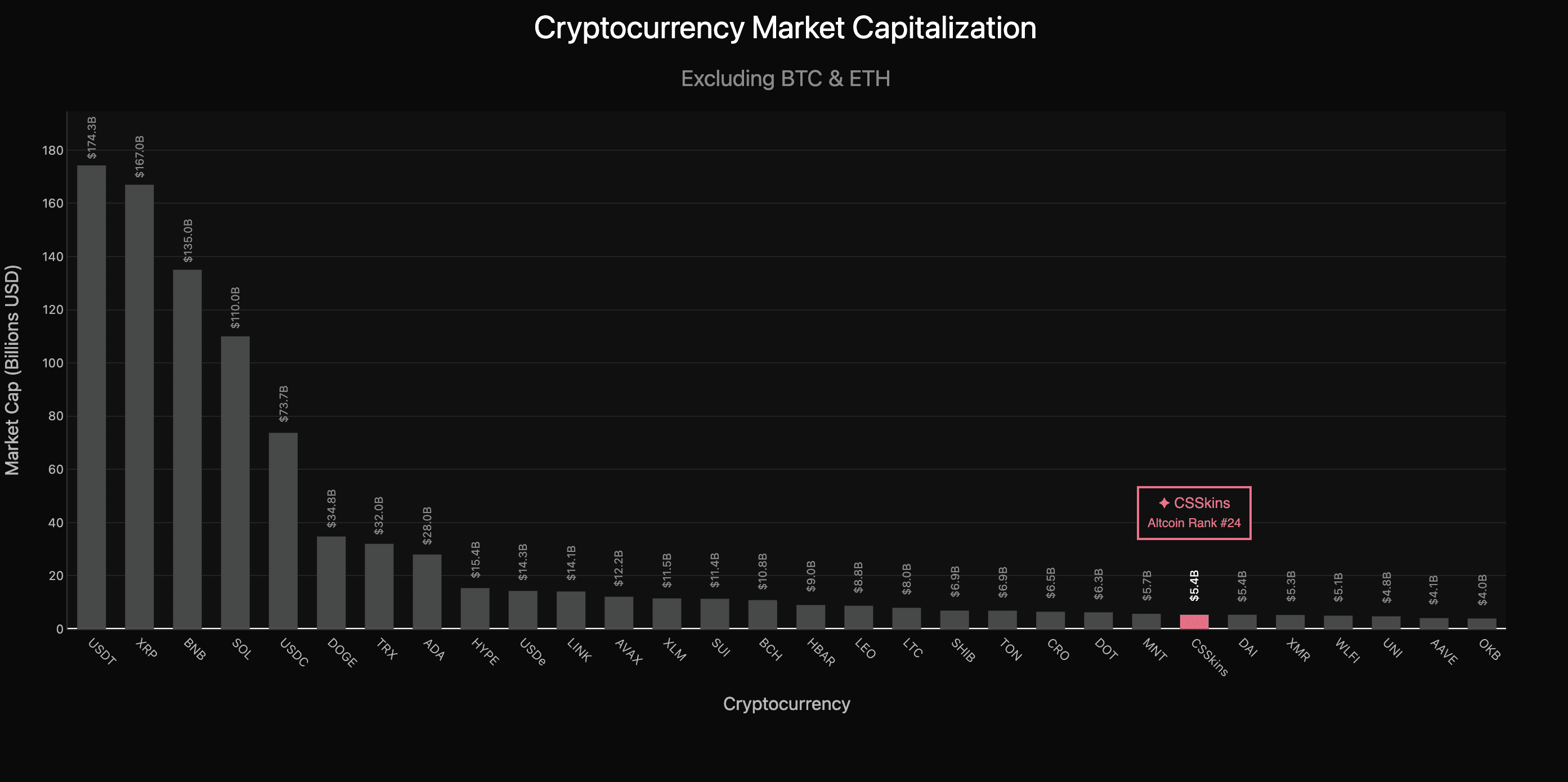

Despite this structural restriction to trading, Counter-Strike’s skin economy remains one of the largest digital-asset markets outside of crypto. According to PriceEmpire, which multiplies Buff163 reference prices by each skin’s circulating supply, the aggregate notional value of all tradable skins stood around $5.4 billion as of October 2025.

That would rank the CS-skins market roughly 24th among all cryptocurrencies by market capitalization.

This figure is not a fully liquid valuation, it assumes all inventoried skins are tradable and uses Buff163 pricing, which can vary slightly from Western venues, but even after a 20 % liquidity cut, the market would still rival top DeFi tokens such as Aave ($4.4B) or Ethena (4.3B).

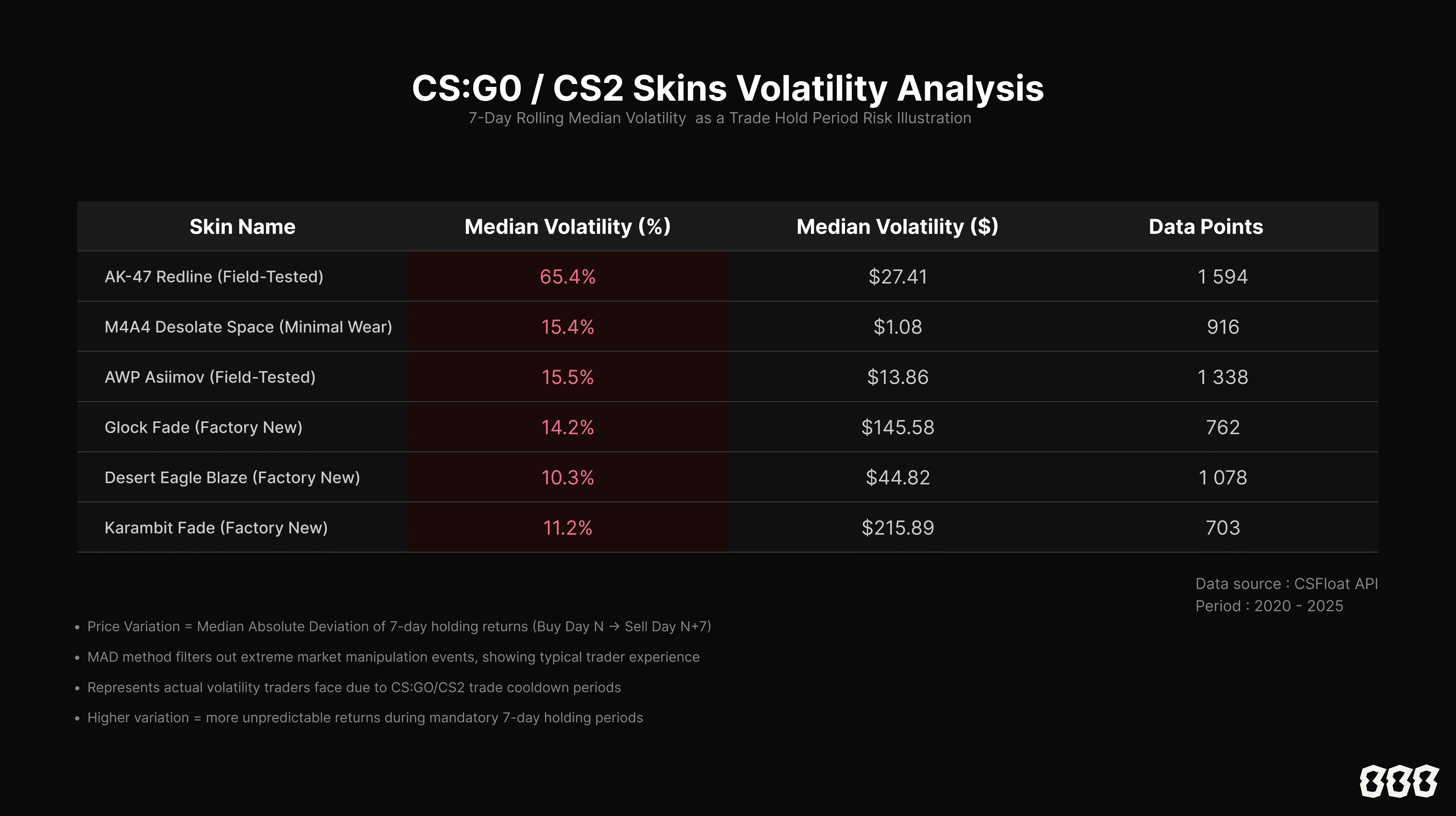

Coming back on the 7 day cooldown, it poses a real risk for traders. We computed the 7-Day median Volatility with price data from CSFloat for some of the most traded skins and the data speaks for itself. All the skins studied experience a median volatility above 10% with the most liquid (AK-47 Redline Field-Tested) reaching 65.4%. This annualizes to 469% for the AK and 108% for skins with a median volatility of 15%. For reference, current 7-day annualized volatility sits at 37.8% for Bitcoin and 78.6% for Ethereum.

Results can be mitigated with the fact that the data comes from CSFloat, which is less renowned for pricing skins that Buff163. CSFloat data tracks Western market activity, likely underrepresents Asian liquidity, meaning actual realized volatility could be even higher.

In traditional financial markets, any seven-day locked-capital risk this high would immediately be priced, either through a volatility premium or a derivative. The fact that no such pricing exists here means the market systematically under-rewards liquidity providers and over-exposes speculators.

This is historically what has pushed the adoption of short term derivatives in traditional finance. Since their creations some farmers, because they can't know the price of what they produce in advance, have hedged their production with options in order to reduce their risk.

The data defines a simple problem: forced time exposure without a hedge. The next step is figuring out how a prediction-market layer could turn this forced illiquidity into a tradable metric.

Market Design

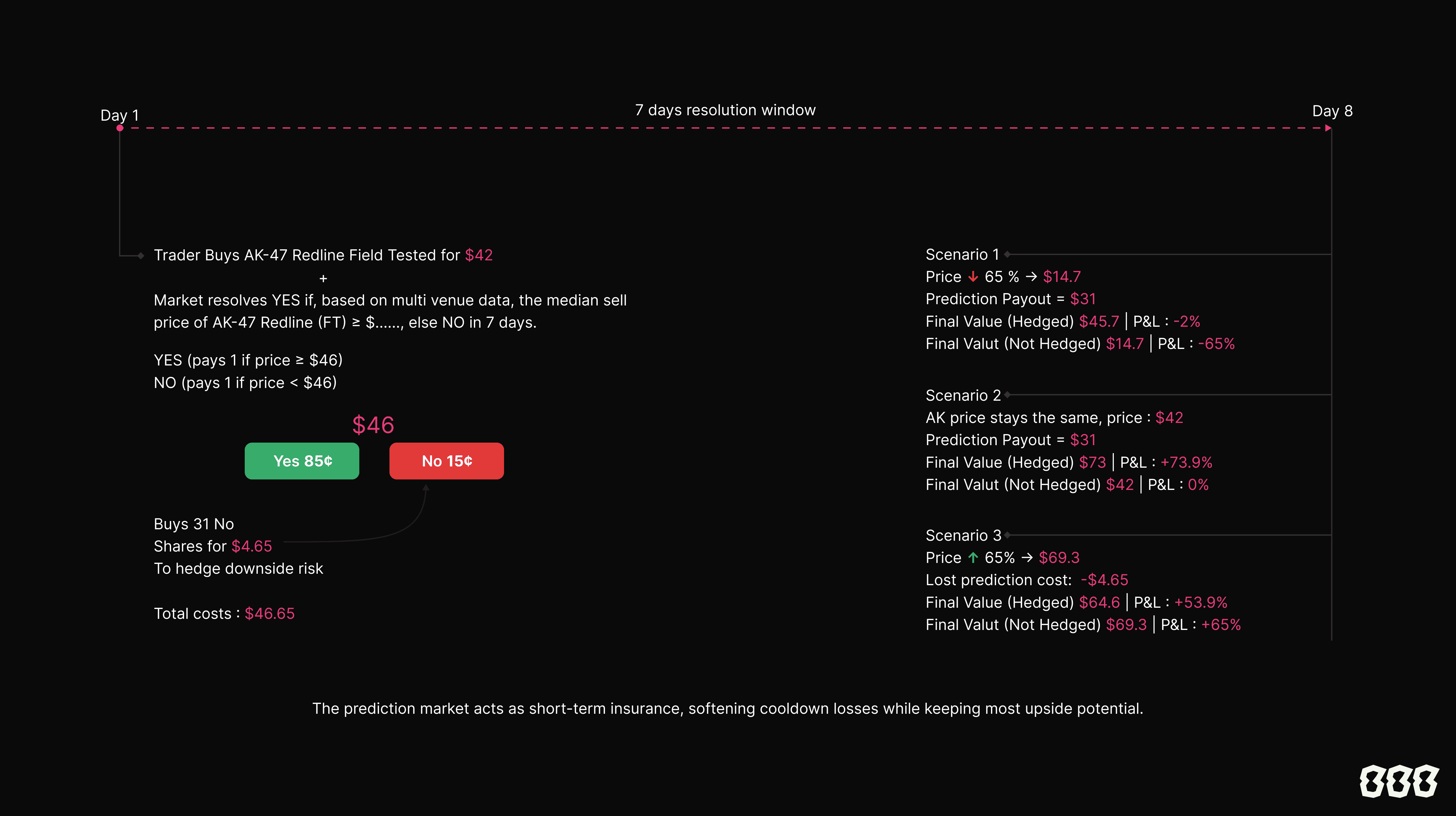

Here is how we envision a market predicting skins prices.

Market structure: a set of price-point markets (strikes). Each resolves on whether the median price of a given skin exceeds its strike level after the 7-day window, based on multi venue data data.

Speculative users gain a transparent, on-chain venue for directional bets anchored to verifiable off-chain prices. Skin traders gain the functional equivalent of binary options to hedge cooldown-period risk.

Resolution

The main vulnerability of a prediction market on skins lies in resolution manipulation. Because the CS skins market is relatively illiquid, a single trade can distort reported prices. To reduce this risk, three safeguards should be built into the market design:

Curated universe of reference assets

Only the most liquid and actively traded skins should be eligible as reference items.

Including thinly traded skins would make prices easy to spoof and undermine trust in outcomes.

Median instead of average for settlement

Using the median sale price over a fixed window protects against outliers. Consider a simple example: nine trades occur at $40, and one spoofed trade prints at $1 000 000. A single wash trade pushes the “average” price from $40 to over $100 000 — a 2 500× distortion.

The median, on the other hand, is simply the middle value once prices are sorted: $40. It remains unchanged, reflecting the true market value. By anchoring resolution to the median, manipulation becomes expensive and largely ineffective.Transparent and cross-venue data sources

Settlement should rely on aggregated, publicly auditable data across multiple marketplaces, for example, Buff163, Skinport, CSFloat, and other high-liquidity venues. Cross-venue aggregation reduces the chance that a single platform’s anomalies can bias the result, and timestamped records allow any participant to verify or contest the feed.

We’ve seen how prediction markets thrive in chaos. But not every market suffers from noise,some suffer from silence. Real estate is one of them.

Square meter housing prices per city

In part one, we explored how prediction markets can create hedging primitives in illiquid, high-volatility digital economies. In this part, we shift toward a different utility: forecasting in slow-moving, high-value markets

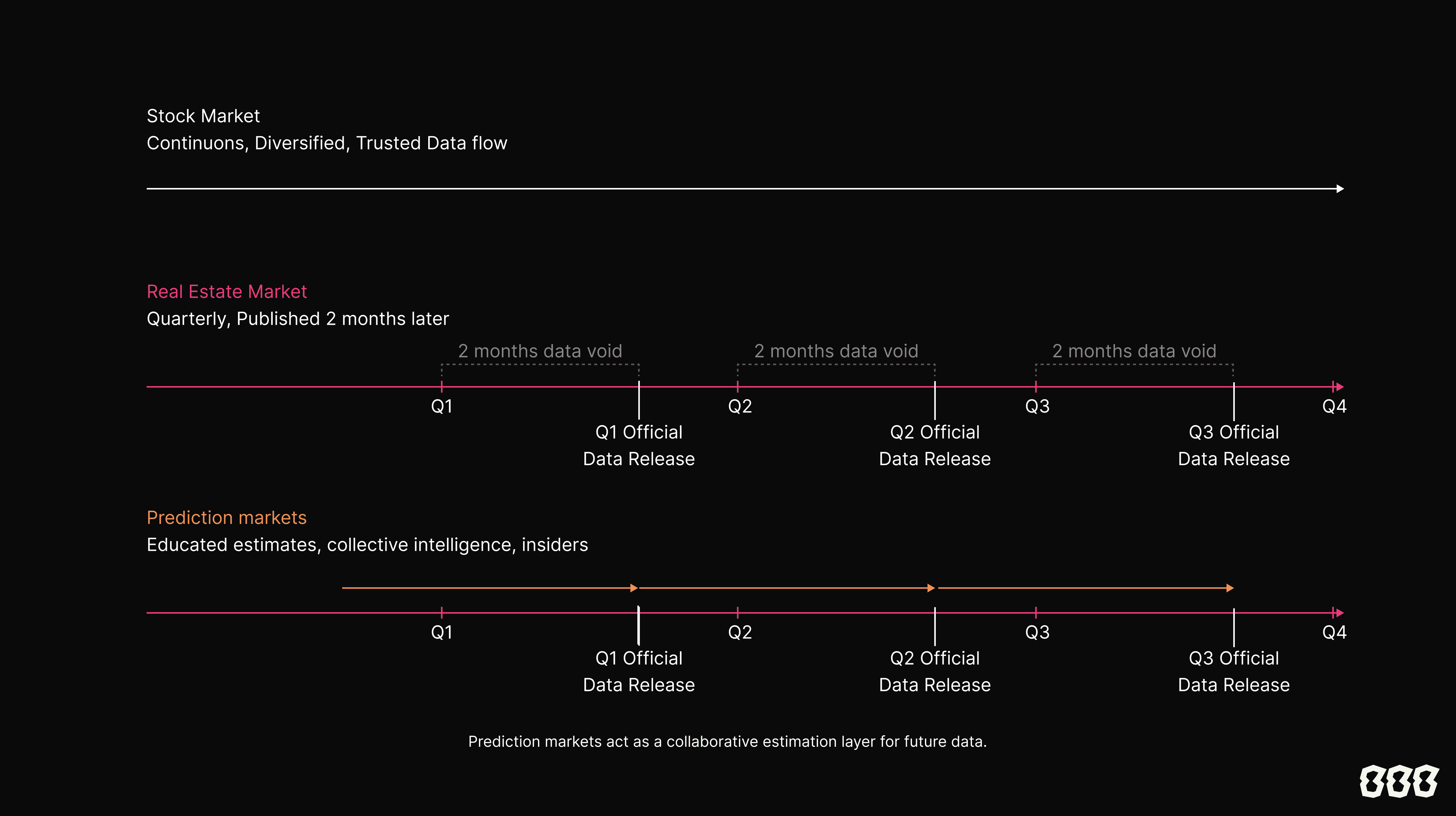

Real estate is the centerpiece of most long-term portfolios, yet it remains structurally opaque. Transactions are slow. Price discovery is lagged. And official data, often released quarterly, trails reality by months.

The chart below highlights this lag: compared to the continuous and diversified data flow of stock markets, real estate price data in France is only published two months after each quarter ends. This delay creates a data void, leaving builders, investors, and policymakers to navigate without current price signals.

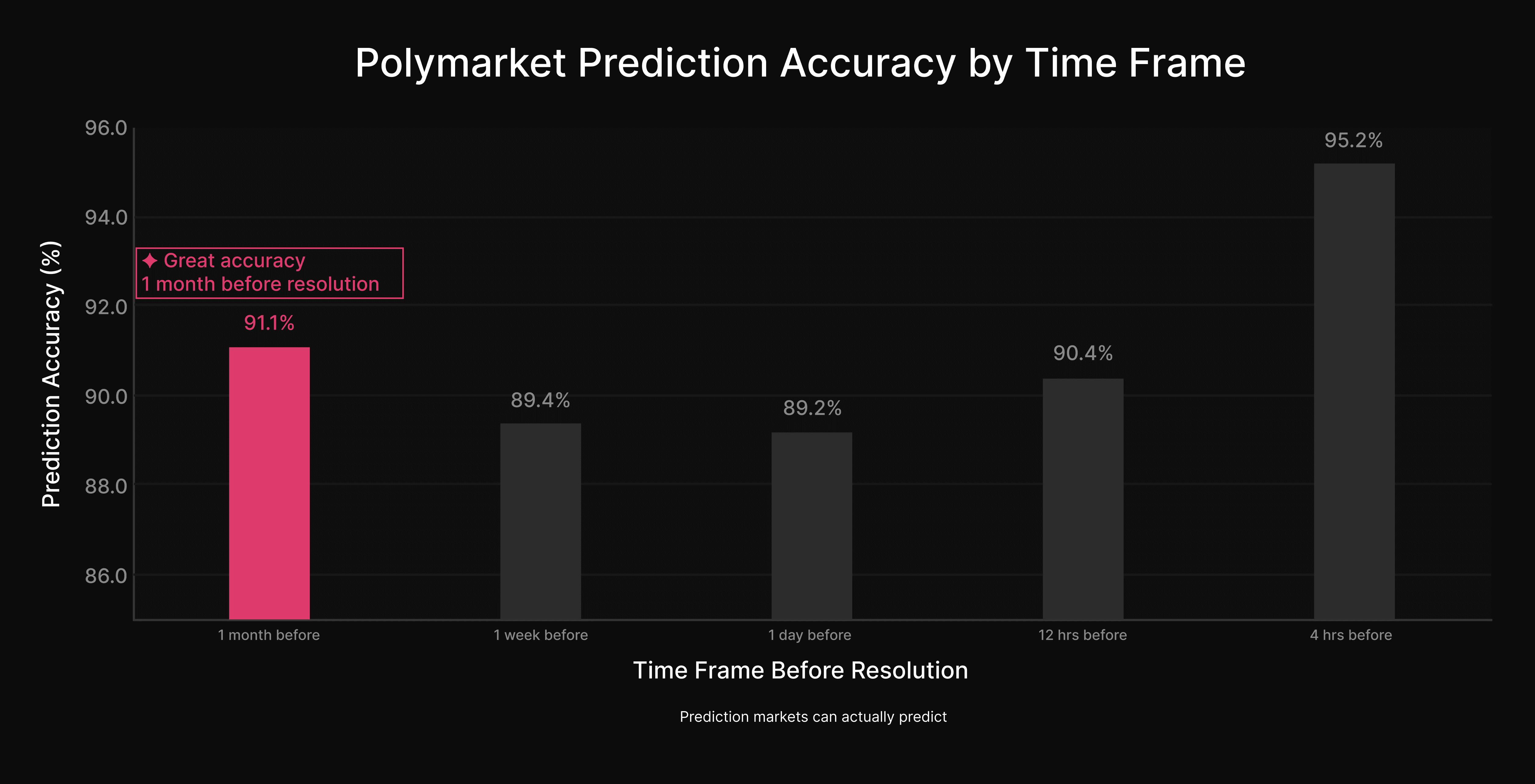

Prediction markets can help fill that gap. By aggregating collective intelligence and incentivizing accurate forecasting, they can offer real-time probabilistic signals where none exist. Historical data from Polymarket shows that these markets achieved 91.1% accuracy one month before resolution, demonstrating that incentives and distributed expertise can yield highly predictive outcomes.

The main vector of accuracy in prediction markets is incentives. On PMs, participants are rewarded for being right. Each contract price represents the results of field experts, insiders, and traders trying to monetize their informational advantage. Additionally, as liquidity on prediction markets increase, the accuracy might increase with new experts and insiders joining.

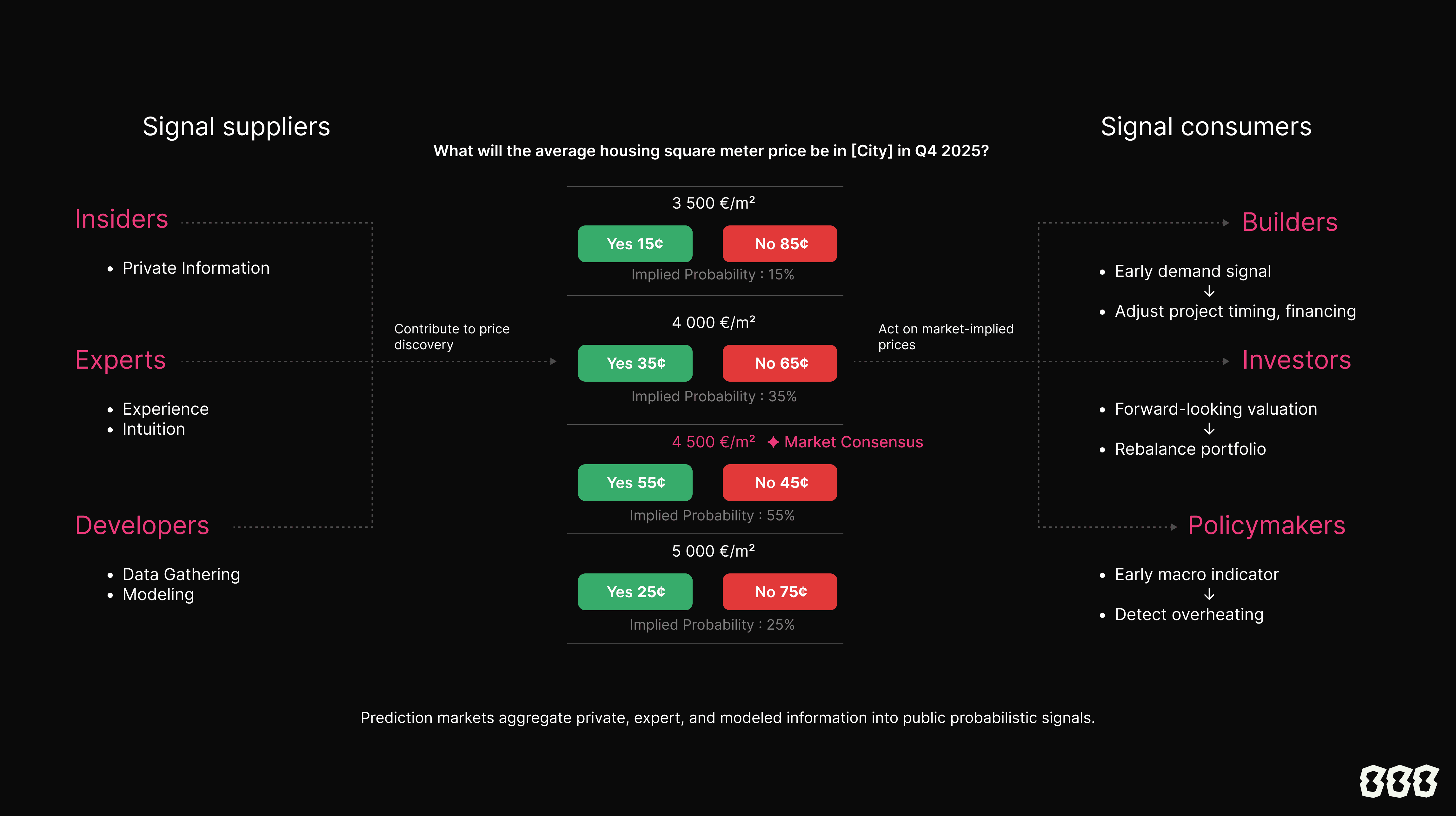

With this foundation, we can explore the utility and design of real estate prediction markets for three stakeholders :

In our market design, Signal Suppliers are incentivized to give the most accurate housing price estimation. This could take many forms, real estate agents in the area observing a pattern, developers scrapping large amounts of data, or insiders coming in before official data is announced. On the other side, with this constant stream of data, signal consumers can adjust their actions instead of relying on their own isolated and often biased methods.

Resolution

The resolution of each contract relies on official government data. For France, the benchmark is the Notaires–INSEE quarterly publication of average square-meter prices per city, which serves as the trusted and verifiable source for all housing market indicators.

Each contract resolves when the corresponding quarter’s data is typically released around two months after quarter-end. If publication is delayed, the resolution window automatically extends by one month until the official figures are available.

This design keeps the process transparent, auditable, and aligned with the most reliable reference in the real-estate market.

Conclusion

Future historians might look back at Polymarket or Kalshi the way we look at the first stock exchanges, chaotic, unserious, but inevitable.

They’ll see that the noise was a feature, not a flaw. Every click, every bet, every trade was teaching a system how to see the future a little more clearly.

A new layer of finance is already here.

It doesn’t trade money, it trades foresight.

Maybe it’s time we opened one of these markets ourselves. What do you think?